Already a member? Sign in below

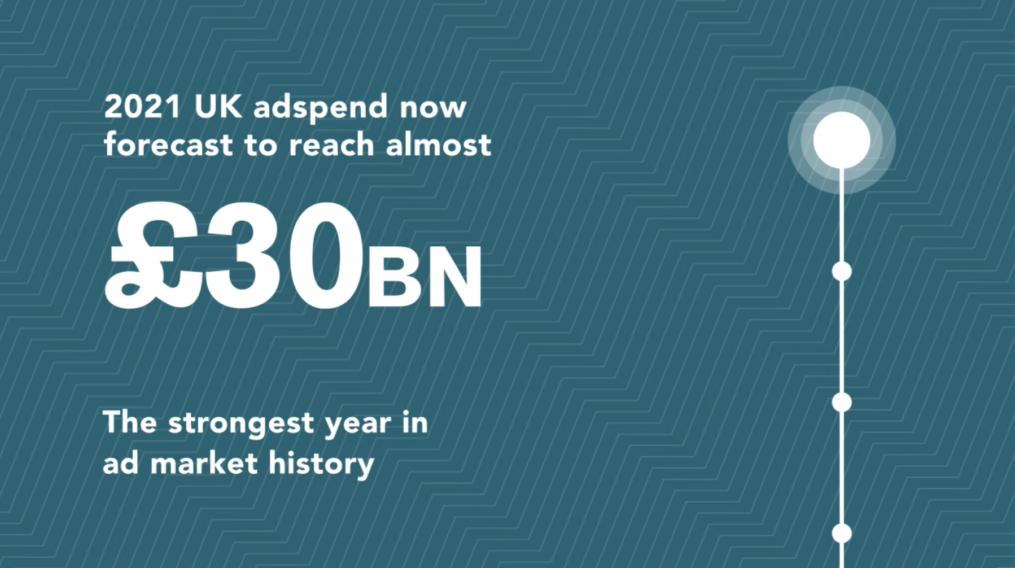

Record 26.4% growth put market value at an estimated £30bn last year, with advertising spend now set to reach £32bn in 2022

London, January 27, 2022: The latest Advertising Association/WARC Expenditure Report has outlined an even greater recovery for the UK’s advertising market than previously expected, with revised estimates for growth in 2021 standing at 26.4% to reach a total of £29.7bn.

The new findings – published today – upgrade October’s projection for 2021 (+24.8%) by 1.6 percentage points, equating to the strongest year in UK ad market history. This is supported by the actual data released for Q3 2021, showing adspend of £7.3bn – the largest-ever summer spend on record.New forecasts also show total investment for 2022 is set to rise by 8.5% to £32.2bn – meaning the UK market will have expanded by more than a third since 2020. A bright start to the year contributes to an upgrade of almost one percentage point for 2022 growth, while sectors especially hit by the Covid-19 pandemic – such as cinema and out-of-home – will expect to see a continued recovery.

In addition, these recovery projections are supported by international data from WARC which expects the UK’s bounce-back in 2021 to be the largest across any major international ad market – including the USA, France and China – while outstripping the global rate by more than 12 percentage points.[1]

Best-ever summer confirmed in 2021

Actual figures released by AA/WARC confirm adspend rose 23.2% during Q3 2021 to a record £7.3bn – three percentage points and £183m ahead of forecast. All media recorded double-digit growth in Q3 2021 following the previous year’s decline, as the summer period saw the return of key sporting moments such as the Euros, Olympics and Paralympics along with the easing of Covid-19 restrictions.

Triple-digit growth was confirmed for cinema (+655.9%) to £20.2m, marked by the September release of James Bond’s No Time to Die, while out-of-home saw an increase of 62.6% to £270.4m. Regional newsbrands saw online ad revenue overtake print for the second quarter running, as online revenue grew to £67.5m (+55.7%) with combined investment of £132.7m (+22.4%).

2022 market will have grown by more than a third since 2020

UK adspend is expected to continue to rise to £32.2bn this year as current projections anticipate 8.5% growth, including strong recoveries for cinema (+201.1%) and out-of-home (+26.8%). Continued growth is also expected from the largest advertising channels, including search (+11.1%), online display (+8.3%) and TV (+5.3%) as consumer habits gained during the pandemic are expected to be retained.

The latest figures suggest Q1 2022 also looks to be stronger than expected (particularly within TV) and overall adspend is now forecast to grow 12.6% year-on-year, compared with 10.5% previously.

Stephen Woodford, Chief Executive, Advertising Association said:

“UK advertising has seen a remarkable recovery from the coronavirus pandemic, racing ahead of key international markets with spend expected to cross the threshold of £30bn this year. A strong advertising market is a key indicator of the UK economy’s growth, with every £1 spent on advertising generating £6 GDP. The latest AA/WARC report brings welcome news not just for our industry but for the wider economy, as advertising investment is a key lever for businesses to capture new markets and drive their recovery.

“It is all the more important therefore that the Government recognises the need to support industry-led skills training to complement the demand for digital skills required to keep this market booming.”

James McDonald, Director of Data, Intelligence & Forecasting, WARC said:

“The latest verified data support our previous estimation that 2021 was the strongest year for the UK’s advertising market since monitoring began. Encouragingly this momentum appears to have sustained into the new year, with the impact of the Omicron variant on advertising trade appearing to be reasonably muted across the majority of sectors.

“While inflation is set to act as a headwind on both the consumer and media buyers alike in the coming months, we have little reason to believe that the UK’s ad market won’t achieve growth of 8.5% this year – well ahead of the average recorded during the decade preceding the outbreak.”

| Media | Q3 2021

year-on-year % change |

9M 2021 year-on-year % change | 2021 forecast year-on-year % change | Percentage point (pp) change in 2021 forecast vs Oct | 2022 forecast year-on-year % change |

| Search | 18.7% | 36.7% | 31.0% | +0.9pp | 11.1% |

| Online display* | 20.5% | 32.8% | 26.9% | +1.5pp | 8.3% |

| TV | 28.9% | 30.6% | 26.1% | +3.2pp | 5.3% |

| of which VOD | 33.9% | 39.4% | 37.5% | +3.4pp | 13.7% |

| Online classified* | 36.8% | 31.6% | 25.8% | +1.2pp | 3.9% |

| Out of home | 62.6% | 14.2% | 25.4% | -2.2pp | 26.8% |

| of which digital | 68.7% | 24.8% | 35.7% | -2.4pp | 35.4% |

| Direct mail | 23.4% | 21.0% | 17.1% | +6.8pp | -6.8% |

| National newsbrands | 25.4% | 11.7% | 10.9% | +3.3pp | 1.4% |

| of which online | 22.8% | 22.4% | 17.4% | +4.2pp | 6.4% |

| Radio | 30.7% | 28.9% | 21.7% | +4.0pp | 4.0% |

| of which online | 49.7% | 54.5% | 41.4% | +6.7pp | 10.7% |

| Magazine brands | 22.3% | 24.4% | 20.4% | -1.2pp | -3.0% |

| of which online | 41.0% | 62.2% | 45.9% | +4.0pp | -1.0% |

| Regional newsbrands | 22.4% | 7.8% | 7.8% | +0.4pp | -6.1% |

| of which online | 55.7% | 37.0% | 33.2% | +8.2pp | 0.9% |

| Cinema | 655.9% | -57.0% | 70.0% | -18.0pp | 201.1% |

| TOTAL AD SPEND | 23.2% | 30.8% | 26.4% | +1.6pp | 8.5% |

| Note: Broadcaster VOD, digital revenues for newsbrands, magazine brands, and radio station websites are also included within online display and classified totals, so care should be taken to avoid double counting. Online radio is display advertising on broadcasters’ websites.

Source: AA/WARC Expenditure Report, January 2022 |

|||||

The Advertising Association/WARC quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK with data and forecasts for different media going back to 1982.

[1] International adspend is calculated in USD. Projected figures for 2021 growth: UK (36.0%), global (23.8%), China (23.8%), France (23.6%), USA (21.7%).

Already a member? Sign in below

If your company is already a member, register your email address now to be able to access our exclusive member-only content.

If your company would like to become a member, please visit our Front Foot page for more details.

Enter your email address to receive a link to reset your password

Your password needs to be at least seven characters. Mixing upper and lower case, numbers and symbols like ! " ? $ % ^ & ) will make it stronger.

If your company is already a member, register your account now to be able to access our exclusive member-only content.