Channel 4’s recent report, ‘Gen Z: Trends, Truth and Trust’ thrust the topic of trust amongst the young into the spotlight, with some interesting findings, prompting plenty of discussion.

The report brought into sharp relief what Credos’ own research has been showing for many years: the single biggest differential when it comes to trust is age. In summary, the older we get, the less likely we are to trust most things, advertising in particular, as we have explored previously.

In 2024, 57% of 18-34-year-olds said they trusted advertising, compared to 44% of 35-54-year-olds and just 21% of those over 55. This divide is widening over time, with young people becoming more trusting, and older cohorts remaining distrusting.

However, 18-34 is a broad age range encompassing two generations (Gen Z and millennials). Channel 4’s focus on Gen Z prompted us to take a closer look at the young. Expecting to unveil something within the Gen Z cohort, we were instead surprised by the data relating to the 25-34 group, leading us to ask the question: what is going on with millennials?

Trust in Advertising

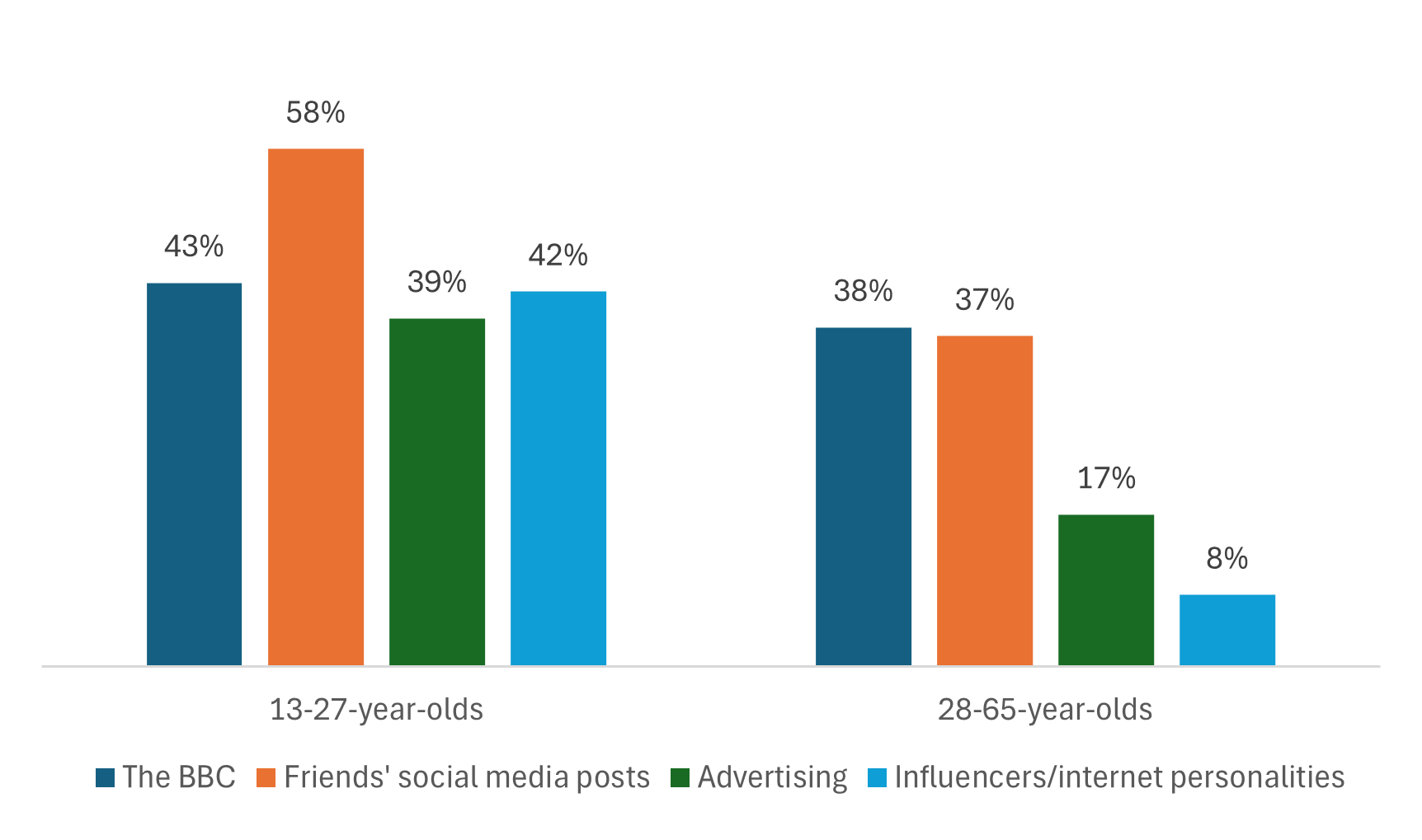

Channel 4’s research demonstrates what the authors describe as a “flatter hierarchy of trust” amongst Gen Zs than the general population. The “flatter hierarchy of trust” suggests that, for Gen Z, trust is no longer distributed top-down, from institutions and experts to the public, but sideways to all sources, including friends and influencers.

Figure 1, taken from Channel 4’s report, demonstrates this “flatter hierarchy of trust” amongst Gen Z.

Figure 1. Gen Z vs 28-65-year-olds’ trust in media [1]

Source: Channel 4 & Craft Research. Base: UK 13-65-year-olds, n=2,000

Though their question and age breaks may differ from ours, Channel 4’s findings clearly mirror our own that older generations trust advertising less than the young. However, our research shows that Gen Z are not the most trusting generation.

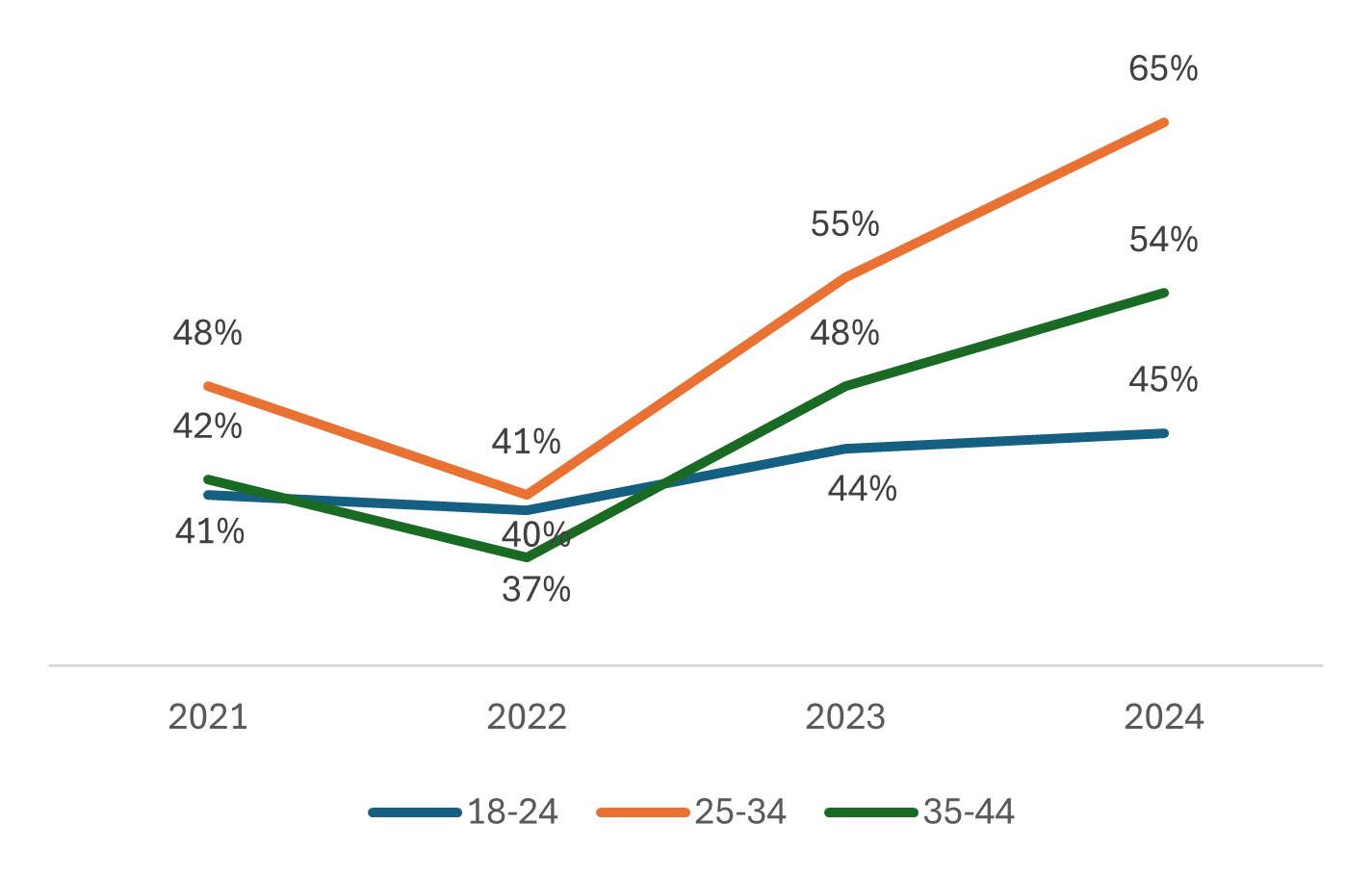

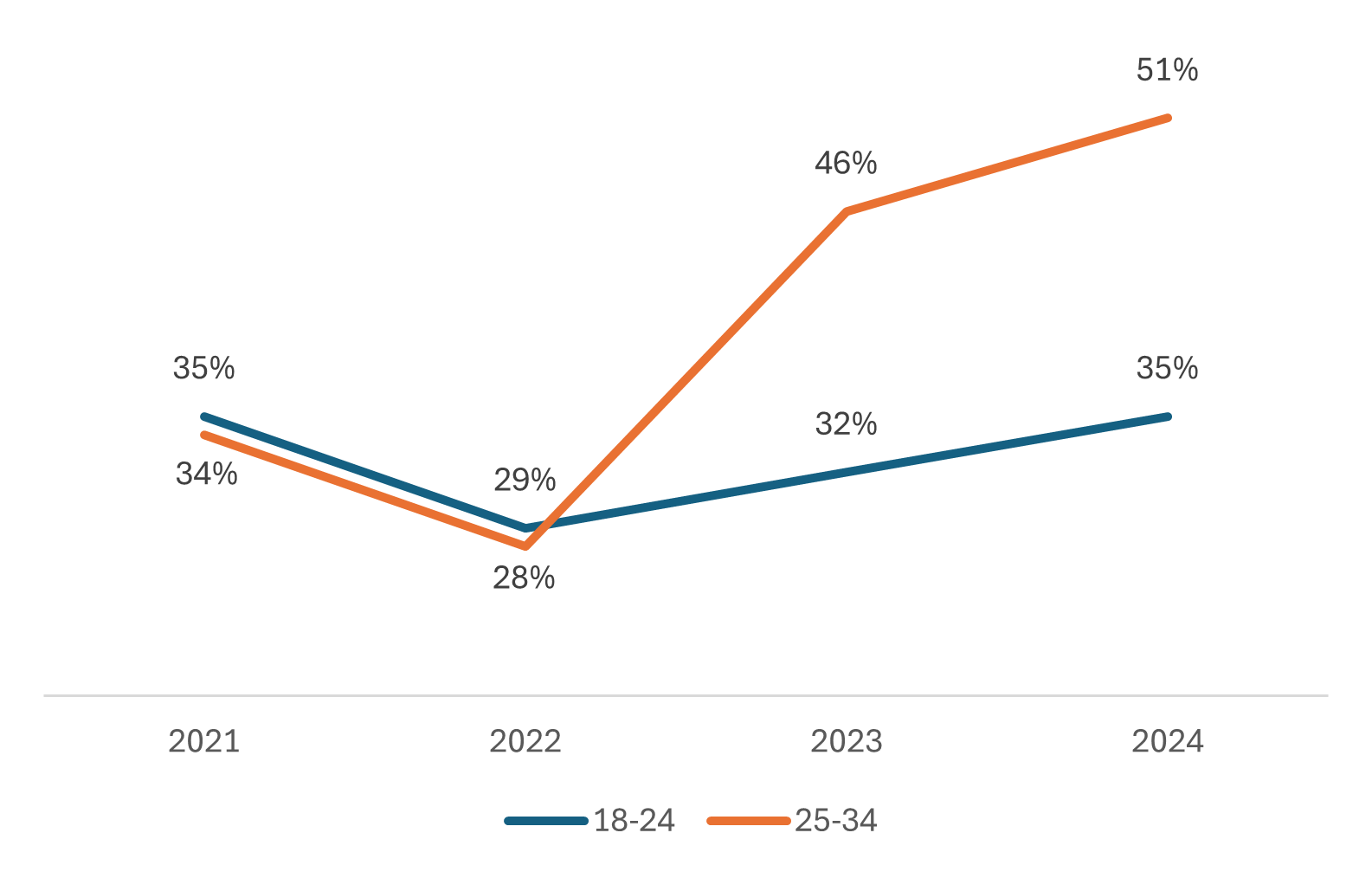

Figure 2 shows Credos’ results on trust in advertising amongst 18-24-year-olds, 25-34-year-olds and 35-44-year-olds from 2021 to 2024.

It is important to note that our survey age breaks do not fall neatly into the generation divides (In 2024, Gen Z were aged 13-27 and Millennials 28-43) [2]. Here, we use 18-24 as a sample of Gen Z, while 25-34 acts as a proxy for young millennials, despite including some Gen Z respondents. The 35-44 cohort consists almost entirely of millennials.

Figure 2. Trust in advertising amongst 18-24-year-olds, 25-34-year-olds and 35-44-year-olds, 2021-2024 [3]

As Figure 2 shows, trust in advertising has skyrocketed amongst millennial respondents over the past couple of years, rising by 24%-points for the 25-34 group since 2022 and 17%-points for the 35-44 group.

This meant that, in 2024, the 25-34 age group were 20%-points more trusting than 18-24s, while even the 35-44s were significantly more trusting than the youngest cohort. This is a new development – in previous years, the 18-34 age group has not been split in this way, with the 18-24 group usually more trusting than the 25-34 group.

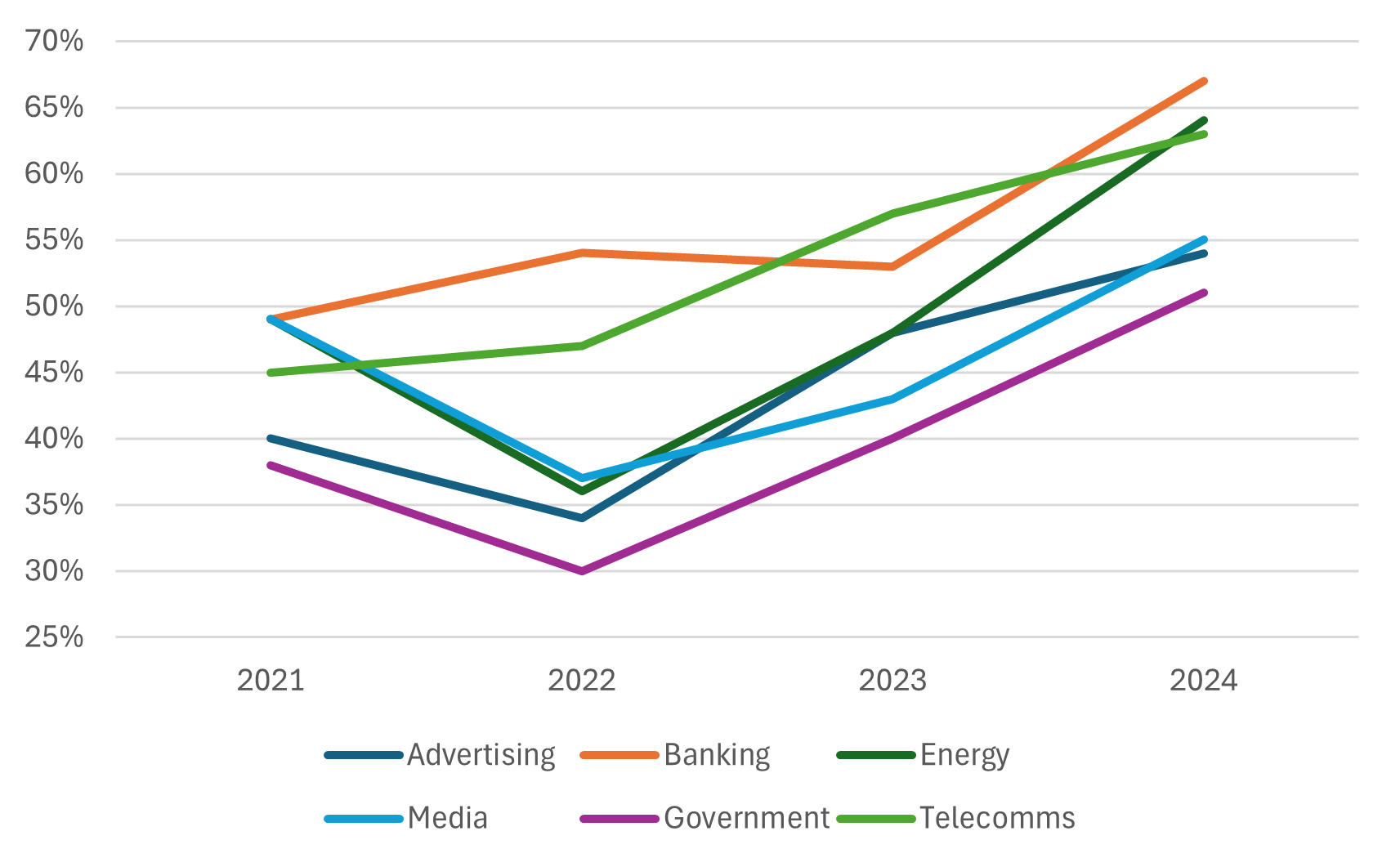

Interestingly, as shown in Figure 3, this pattern of a significant drop in trust in 2022 and a strong rebound in 2023 and 2024 is mirrored in many industries, suggesting that there are external factors impacting the 25-34-year-old cohort’s trust.

Figure 3. 25-34-year-olds’ trust in all industries, 2021-2024 [4]

One hypothesis is that events occurring during 2022 – the cost-of-living crisis, the start of the Russia-Ukraine war, and a floundering UK government – were impacting trust amongst millennials in some way.

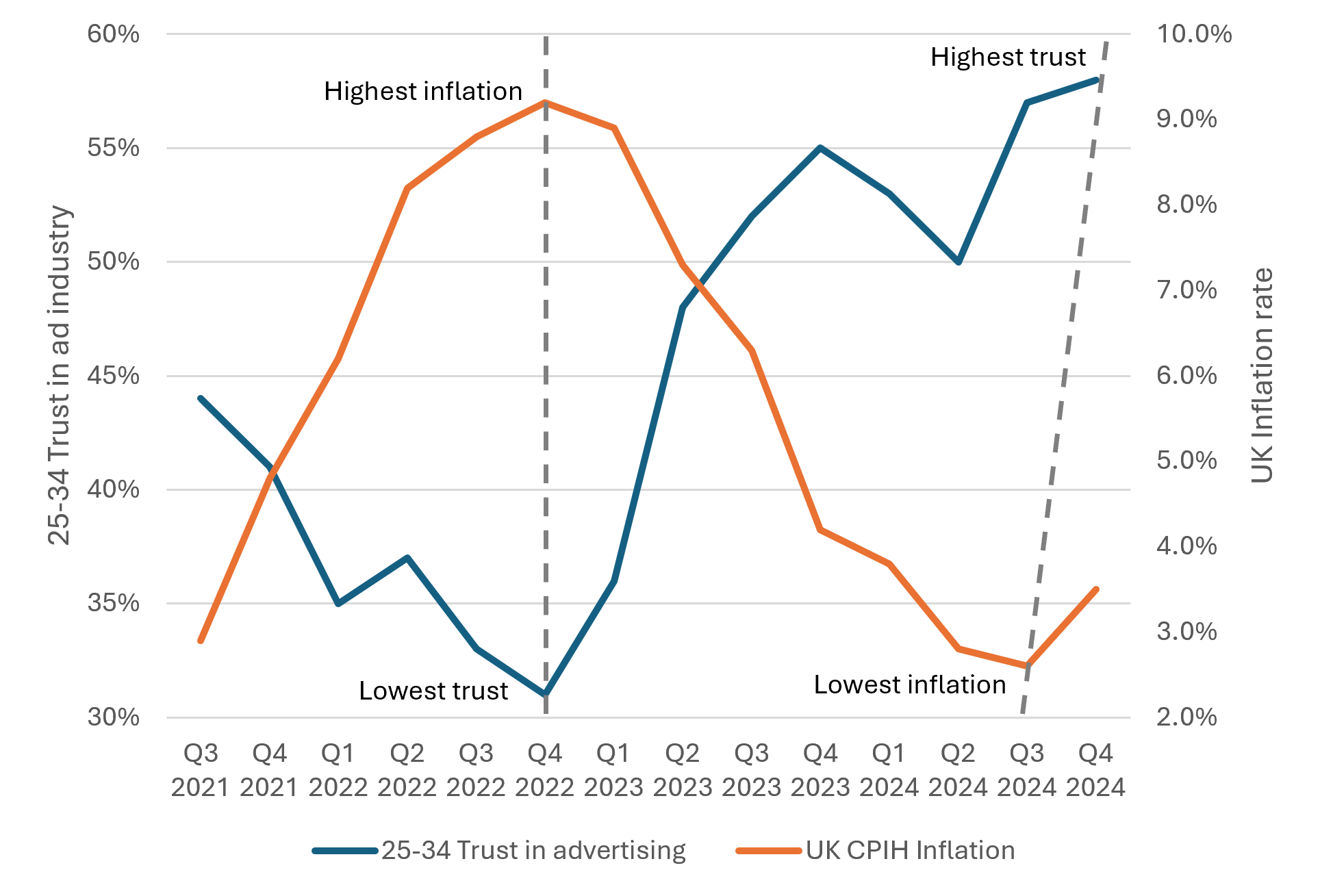

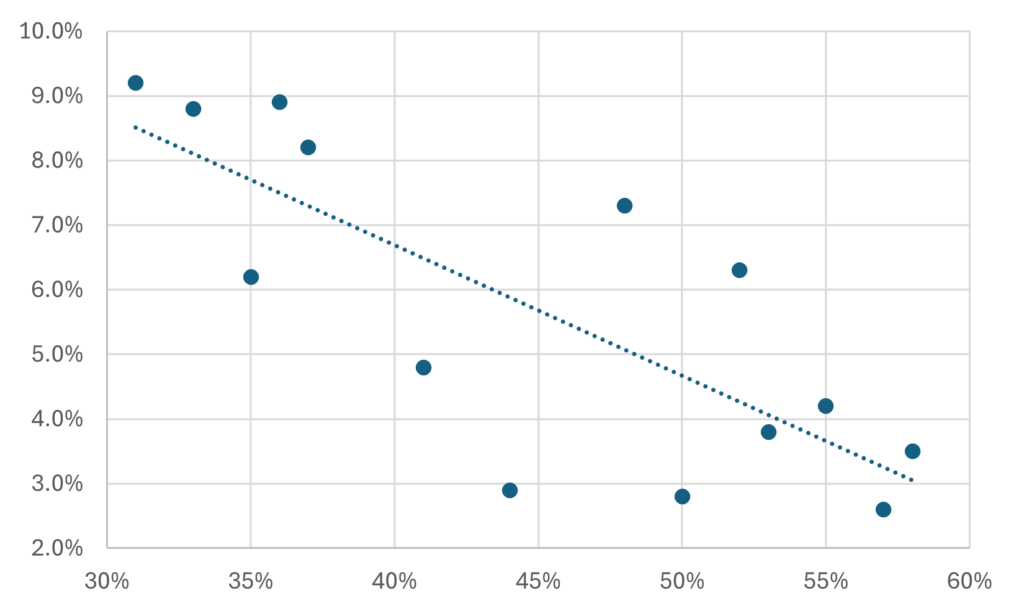

In fact, when mapping 25-34-year-olds’ trust in the advertising industry against UK inflation, the extent of the correlation is remarkable [5]. Figure 4 demonstrates the apparent negative correlation between inflation and trust in advertising amongst this age group from Q3 2021 to Q4 2024.

Figure 4. Trust in ad industry amongst 25-34s [7] and UK CPIH inflation [8], Q3 2021-Q4 2024

From Q3 2021, inflation rises steeply until Q4 2022, with trust dropping concurrently. Between Q4 2022 and Q3 2024, inflation then drops and trust rebounds. Unsurprisingly, a similar trend of negative correlation can be drawn for trust in energy and Government – both industries that were inherently linked to inflation rises during the period.

It is also worth noting that a similar trend, although less strongly correlated, is seen in older millennials, whereby trust drops to lows between Q1 2022 and Q1 2023, before rising overall as inflation comes back down again.

Understandably, trust amongst millennials is the most impacted by highly changing inflation; they are the cohort most likely to be having children and making rent or mortgage payments, while not being as settled in higher-paying long-term careers as those over the age of 44. It does not appear that inflationary pressures impact Gen Z trust to nearly the same extent as millennials.

Perhaps more surprising is that trust amongst 25-34-year-olds has not just rebounded to pre-inflation crisis levels but surpassed it by some margin. Whether that is due to post-inflation relief, advertising-specific effects, or other external influences remains to be seen.

We should be careful not to overstate the link between inflation and trust in advertising (and other industries). In periods of relative inflationary stability, trust will be impacted by many factors above the current inflation rate. The strength of correlation that we see in the graph above is likely only true in periods of high fluctuation. Positive drivers of trust such as creativity, enjoyment, social contribution and economic contribution, as well as negative drivers including bombardment and suspicious advertising remain highly important in sustaining public trust.

Millennial Trust in Influencers

Gen Z could accurately be described as a ‘digital native’ generation. They have grown up with the online world as a fundamental part of their lives – from play, to communication, to education, news and beyond. An increasingly important part of that online world is the rise of influencers.

Channel 4 found that Gen Z trust influencers/internet personalities more than advertising (42% vs 39%) and seemingly much more than older generations. But our research suggests that they are considerably less trusting of influencer advertising than young millennials.

In line with their general rise in trust, trust in influencer advertising is growing rapidly amongst 25-34-year-olds, while trust amongst the 18-24 group remains level with 2021 figures, as demonstrated by Figure 5 below.

Figure 5. Trust in influencer advertising, 18-24-year-olds and 25-34-year-olds, 2021-2024 [9]

Though Gen Z are the generation of ‘digital natives’, their trust in influencers is not keeping pace with the generation before them. It will be interesting to see whether trust in both advertising and influencers remains at such a high level amongst the 25-34 cohort now that inflation has settled somewhat.

There may well be other effects separating the generations in their trust of influencers. The very fact of being digitally native may be suppressing Gen Z’s trust in influencer advertising, relative to the 25-34 cohort – it is possible that some within the age range feel savvy to, and aware of, online harms in ways that the generation before them do not.

What is clear, is that the 25-34 group are more trusting of most industries than the 18-24s, albeit to a lesser degree than advertising. To what extent this is part of a wider rejection of institutions and modern technologies is unclear.

Conclusion

Gen Z are undoubtedly growing up in a time when the media landscape has become fragmented and, in some cases, untrustworthy. The prevailing narrative has been that the very youngest in society are the most trusting of advertising and modern advertising media channels as they are the most comfortable navigating them.

However, it is becoming clear that trust in advertising is now higher amongst millennials than it is in Gen Z. Credos will be keeping an eye on this trend amongst the very youngest respondents in our quarterly trust tracking.

The sheer volume of options, sources and viewpoints accessible to the youngest generation may be creating a split in worldview between them and millennials. While millennials largely embraced the multiplicity of media, it seems that 18-24-year-olds are now more sceptical and no longer the most trusting cohort.

References

- Channel 4 & Craft Research: Gen Z: Trends, Truth and Trust Craft, survey. Base: UK 13-65-year-olds, n=2,000 – C2 & C4

- https://www.beresfordresearch.com/age-range-by-generation/

- Credos Trust Tracker, 2024, Base: 18-44-year-olds, N=1074

- Credos Trust Tracker, 2021-2024. N=c.400 per year

- When running a Pearson calculation to measure the strength of correlation, R = -0.78. This is a strong negative correlation, meaning that high X variable scores go with low Y variable scores and vice versa. The P-value is 0.00109, meaning that the correlation is highly unlikely to be due to chance

- Data when plotted as a scatter graph:

- Credos Trust Tracker, Q3 2021-Q4 2024

- ONS, Consumer Price Inflation, UK: January 2025

- Credos Trust Tracking, 2021-2024, Base: 18-34-year-olds, N=C.700 per year