Higher-than-expected increase driven by search and online display

Preliminary estimate for 2023 UK adspend upgraded to £37BN, a rise of 6.4% year-on-year

London, January 25, 2024: The latest quarterly data from the Advertising Association and WARC Expenditure Report shows UK advertising spend rose by 15.9% to a total of £9.6bn for the period July to September 2023. This marks the first time that advertising spend in Q3 has exceeded the £9bn mark, driven predominantly by a sharp increase in online advertising.

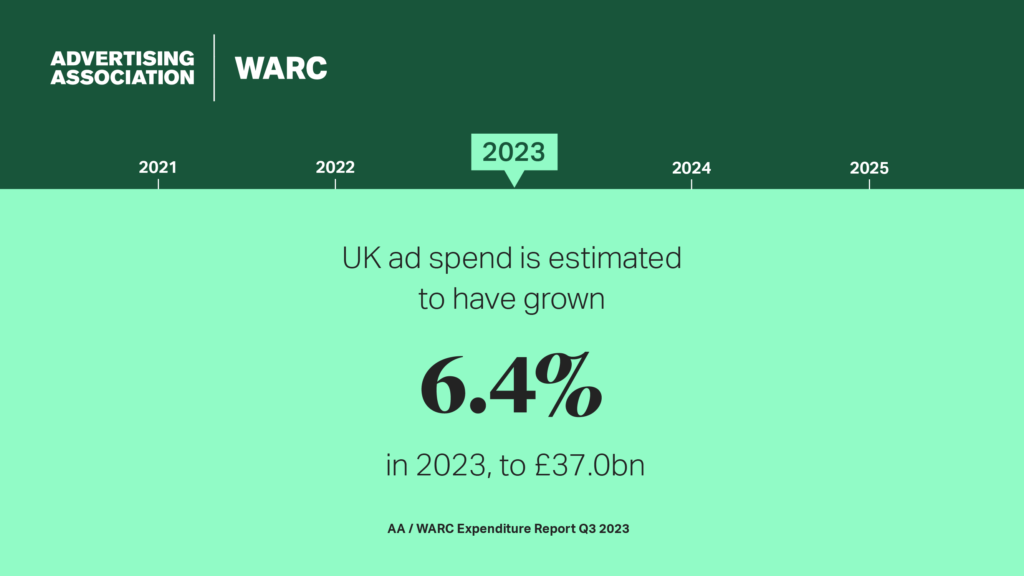

The UK advertising market is now thought to have grown by 6.4% in 2023, reaching a total of £37bn for the year, which represents a sizeable 3.8pp upgrade from the previous forecast (published in October 2023), with final figures for FY 2023 due to be published in late April 2024. The projection for advertising spend this year has been upwardly revised to £39bn, equating to a year-on-year increase of 5.9%. All of this is further evidence of increased confidence in advertising and marketing spend, echoing the recently released IPA Bellwether figures which showed UK marketing budgets for 2024 have seen the greatest upwards revisions in more than a decade.

A closer look at Q3 2023 results

Despite the wider economic market conditions, search (including retail media) and online display (including social media) advertising spend generated higher-than-expected figures in Q3 2023. Search marked its strongest performance in 18 months rising by 23.7% and online display followed suit with a 24.8% increase, also achieving its highest gain in the same period. For comparison, online growth in France was approximately 5% during the quarter, while the UK grew 4.6 times faster at 22.3%. Online retailers increased their online ad spend in the UK market by 156% during Q3 2023 as competition for household budgets increased.

Other channels also experienced growth in Q3 2023; cinema was up 21.2% and out-of-home 12.9%, while spend on broadcaster video on-demand (BVOD) increased by 28.4%, reflecting in part the role on-demand viewing played during the Women’s FIFA World Cup.

Looking ahead to 2024

This year will see a continued increase in advertising spend across more channels, with events such as the Men’s Euros this summer, the likelihood of a General Election and residual coverage of the Olympics contributing positively to this trend. TV advertising is set to return to positive figures – up 1.4% year-on-year – mostly driven by increases in BVOD (+14.6%). The latest AA/WARC dataset also expects a return to growth for radio (+2.1%), as well as the online channels of national newsbrands (+2.1%), regional newsbrands (+1.1%) and magazine media (+2.3%).

Stephen Woodford, CEO, Advertising Association, said: “The Q3 increase in 2023 and 2024 forecast upgrade demonstrate advertisers’ continued commitment to investing in their brands, despite the lack of overall growth and stubborn inflationary pressures in the UK economy. The IPA’s latest Bellwether forecast upgrade is further evidence of this, with the strongest improvement in advertiser expectations on total marketing budgets since 2014. Our forecasts indicate the advertising industry is performing better than the wider UK economy, with spend expected to reach £39bn in 2024. All this should provide confidence that the industry is well positioned to help the UK’s economy tackle the economic and social challenges it faces, by promoting product and service innovation, stimulating competition and supporting jobs.”

James McDonald, Director of Data, Intelligence & Forecasting, WARC, said: “With the UK’s economy in the doldrums, the online ad sector’s strongest performance in over 18 months – growing five times faster than in key European markets – came as a welcome respite for an ad industry worth a record £37bn overall last year. Data show that online retailers more than doubled their online advertising spend during the third quarter, as pricing became competitive and brand salience paramount when attracting stretched household budgets. Our expectations for 2024 are now brighter on the tailwind of a strong end to last year and positive sentiment across the marketing and wider business sectors.”

| Media | Q3 2023 year-on-year % change | 9M 2023 year-on-year % change | FY 2023 estimated year-on-year % change | Percentage point (pp) change in forecast vs October | 2024 forecast year-on-year % change |

| Search | 23.7% | 11.2% | 11.3% | +5.7pp | 8.7% |

| Online display* | 24.8% | 12.2% | 13.0% | +5.6pp | 7.4% |

| TV | -3.0% | -8.8% | -7.3% | -1.5pp | 1.4% |

| of which BVOD | 28.4% | 15.9% | 16.2% | +0.1pp | 14.6% |

| Out of home | 12.9% | 7.7% | 8.7% | +1.0pp | 7.3% |

| of which digital | 15.6% | 9.6% | 10.6% | +1.3pp | 8.8% |

| Online classified* | -18.0% | -14.7% | -13.9% | -2.8pp | -3.5% |

| Direct mail | -13.9% | -15.2% | -14.3% | -1.5pp | -5.4% |

| National newsbrands | -2.6% | -6.5% | -4.8% | +0.9pp | -1.6% |

| of which online | -1.5% | -5.9% | -3.8% | +0.6pp | 2.1% |

| Radio | -2.2% | -4.7% | -3.2% | +0.2pp | 2.1% |

| of which online | -15.2% | -5.0% | -3.4% | -4.7pp | 8.0% |

| Magazine brands | -8.2% | -7.6% | -6.3% | -1.0pp | -1.1% |

| of which online | -13.9% | -11.5% | -8.9% | -3.0pp | 2.3% |

| Regional newsbrands | -4.8% | -11.2% | -9.2% | +0.9pp | -2.5% |

| of which online | -1.2% | -7.6% | -5.3% | +1.7pp | 1.1% |

| Cinema | 21.2% | 2.5% | 5.4% | -2.2pp | 4.6% |

| TOTAL UK ADSPEND | 15.9% | 5.8% | 6.4% | +3.8pp | 5.9% |

| Note: Broadcaster VOD, digital revenues for newsbrands, magazine brands, and radio station websites are also included within online display and classified totals, so care should be taken to avoid double counting. Online radio includes targeted in-stream radio/audio advertising sold by UK commercial radio companies, together with online S&P inventory. Source: AA/WARC Expenditure Report, January 2024 |

|||||

The Advertising Association/WARC quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK with data and forecasts for different media going back to 1982.