Already a member? Sign in below

Inflationary pressures persist with minimal growth forecast for 2023

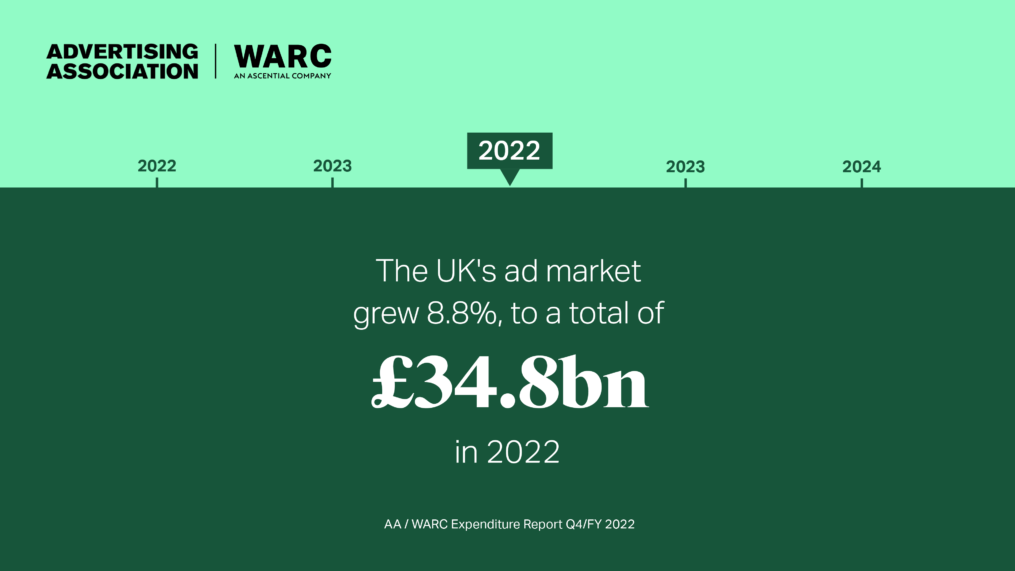

London, April 27, 2023: The Advertising Association / WARC Expenditure Report shows the UK’s ad market grew 8.8% to £34.8bn in 2022, despite a dip in the final quarter of the year. Revised forecasts suggest minimal growth (+0.5%) in 2023, with spend expected to reach £35.0bn, before a 3.9% rise in 2024 to a total of £36.3bn. The revisions follow confirmation that UK advertising spend fell by 5.8% to a total of £8.6bn between October and December 2022, the first time spend had decreased during a fourth quarter since 2009.

2023 projections have been downgraded from the previous forecast (published in January 2023) to +0.5% (compared to +3.8% in January) due to signs that the downturn recorded in the latter half of 2022 has continued into the first half of 2023. Forecasts for the coming year show reduced growth expectations for nearly all sectors of advertising with the economic headwinds of high inflation, muted growth and talent shortages being felt across the industry.

The full picture in 2022:

Actual figures released by the Advertising Association/WARC for the full year in 2022 confirm that spend was up by 8.8%, with the total figure standing at £34.8bn, but the momentum from a strong start to the year was seen to wane in latter months. Data shows that online advertising – 75.1% of total UK spend last year – grew 30.1% in the first half of 2022 before falling 5.4% in the second half. As a result, total UK ad spend growth in the first half of 2022 is upwardly revised to 26.0%, while the total ad market contracted by 5.7% in the second half of the year.

The strongest growth seen in 2022 was for cinema (123.0%) and out-of-home (31.1%), media which continued their year-on-year improvements after a disproportionate impact from COVID-19. Other areas of the industry posted strong figures in 2022: 15.4% year-on-year growth was seen in the Broadcaster Video on Demand (BVOD) component of TV, while Paid Search grew by 12.7%. When reviewed by category, advertising growth was led by services (such as entertainment, media and travel) and industrial (such as business, property and telecoms) products.

Revised projections for 2023 and 2024:

The forecast for 2023’s ad market has been downgraded to +0.5% (compared to +3.8% in January) reaching £35.0bn. Cinema is expected to continue its high levels of growth in 2023 (37.2%) while modest growth is expected in OOH (4.9%). The UK’s ad market is forecast to grow by 3.9% in 2024, totaling £36.3bn as high inflation and stagnation are expected to subside and growth to pick up to a more reasonable rate.

The UK remains the third-largest advertising market in the world, at a value of US$41.5bn, and saw the third-fastest growth rate of the top ten markets in 2022, behind only Brazil (+9.7%) and Australia (+9.4%). Projections from WARC Media however show that the UK is forecast to post the slowest growth among the top 10 ad markets this year.

Stephen Woodford, Chief Executive, Advertising Association said: “These figures reflect the broader macro-economic environment, with a cautious outlook as the UK economy narrowly avoids recession, but shows very little signs of real growth. Advertising investment is an important barometer of business performance and confidence in the economic outlook. It drives competition and innovation, supporting job creation and livelihoods, returning a ratio of £1 invested generating £6 of GDP.”

Annette King, Chair, Advertising Association, said: “It’s clear from these figures that the UK needs a strong plan for growth, one that capitalises on the advertising industry’s talent to help businesses innovate and compete, and support jobs and livelihoods up and down the country. At the same time, we need to address the talent shortages faced by our industry – for example, working with Government to increase flexibility in apprenticeships, and answering the demand for digital skills and expertise which will equip our workforce for the future.”

James McDonald, Director of Data, Intelligence & Forecasting, WARC said: “The latest verified media data reveals that the UK’s ad market entered recession in the second half of 2022, with clear signs that the downturn has continued into the opening months of this year.

“Sharp and sustained falls in social media spend – the first time this has been recorded in the UK – are likely to have been instigated by reduced advertising activity among the SMEs who comprise a ‘long tail’ of ad volume on social platforms and whose margins are under incredible stress as inflation bites. One in every 202 UK companies entered liquidation in 2022 – the highest rate in seven years – and it is unsurprising to see these pressures reflected to some degree within advertising trade.

“Trading conditions are not expected to improve until the second half this year, with economic activity and advertising investment both largely flat during 2023 as a whole. The outlook is set to improve next year, however, as the economy returns to growth, inflation falls nearer to the government’s 2% target and consumer confidence lifts, though advertising spend is still predicted to rise below its long-term average in 2024.”

The latest figures are now available to AA/WARC Expenditure Report subscribers on the newly launched AA/WARC adspend hub. Verified market data across more than 150 series covering major media and product sectors can be visualised in a new dashboard, making insight simple to surface, and a library of over 50 dynamic articles ensures readers always have access to the latest dynamics within their sector.

| Media | 2021 £m |

2022 £m |

2022 year-on-year% change |

2023 forecast year-on-year

% change |

2024 forecast year-on-year

% change |

| Search | 11,658.6 | 13,143.8 | 12.7% | 1.7% | 5.2% |

| Online display* | 10,790.1 | 11,867.8 | 10.0% | 1.7% | 5.3% |

| TV | 5,458.0 | 5,381.0 | -1.4% | -2.0% | 1.6% |

| of which BVOD | 732.8 | 845.3 | 15.4% | 2.5% | 3.6% |

| Online classified* | 1,053.4 | 1,110.8 | 5.4% | -7.5% | -2.7% |

| Direct mail | 1,082.0 | 1,095.0 | 1.2% | -6.0% | -4.0% |

| Out of home | 901.3 | 1,181.2 | 31.1% | 4.9% | 5.9% |

| of which digital | 576.8 | 749.9 | 30.0% | 6.0% | 7.1% |

| National newsbrands | 844.9 | 826.3 | -2.2% | -5.2% | -3.0% |

| of which online | 367.4 | 375.6 | 2.2% | 1.0% | 2.3% |

| Radio | 720.1 | 740.1 | 2.8% | -1.6% | 0.8% |

| of which online | 72.7 | 77.7 | 6.9% | 2.7% | 4.1% |

| Regional newsbrands | 510.5 | 505.2 | -1.0% | -5.8% | -4.9% |

| of which online | 250.9 | 259.2 | 3.3% | -0.8% | 0.7% |

| Magazine brands | 556.4 | 552.1 | -0.8% | -3.2% | -2.6% |

| of which online | 297.7 | 302.2 | 1.5% | 0.9% | 1.6% |

| Cinema | 102.8 | 229.3 | 123.0% | 37.2% | 13.0% |

| TOTAL UK ADSPEND | 31,956.5 | 34,772.1 | 8.8% | 0.5% | 3.9% |

| Note: Broadcaster VOD, digital revenues for newsbrands, magazine brands, and radio station websites are also included within online display and classified totals, so care should be taken to avoid double counting. Online radio includes targeted in-stream radio/audio advertising sold by UK commercial radio companies, together with online S&P inventory. Source: AA/WARC Expenditure Report, April 2023 |

|||||

Already a member? Sign in below

If your company is already a member, register your email address now to be able to access our exclusive member-only content.

If your company would like to become a member, please visit our Front Foot page for more details.

Enter your email address to receive a link to reset your password

Your password needs to be at least seven characters. Mixing upper and lower case, numbers and symbols like ! " ? $ % ^ & ) will make it stronger.

If your company is already a member, register your account now to be able to access our exclusive member-only content.